What is Compounding Knowledge?

I’ve been curious lately about the topic of why people make the decisions they do. There are many recent advancements in the fields of cognitive and behavioral sciences, with interesting podcasts and blogs on these topics to binge on. In a recent podcast, two authorities on behavioral science- Sam Harris and Shane Parrish – discussed compounding knowledge.

Compounding knowledge is a concept first presented by investor and business magnate Warren Buffet, who suggested “Read 500 pages every day. That’s how knowledge works. It builds up, like compound interest.” Buffet and Parrish assert that the principle of compounding can be applied to decisions outside of finance.

Once I learned about the concept of compounding knowledge, I saw obvious connections to the field of data and analytics. Compounding knowledge is often a differentiator between success and mediocrity. It’s the reason some enterprises have been able to maintain momentum and create sustainable value through a culture of data and analytics, while other businesses infuse far more capital into their analytic investments but have much less to show.

What is Compound Interest?

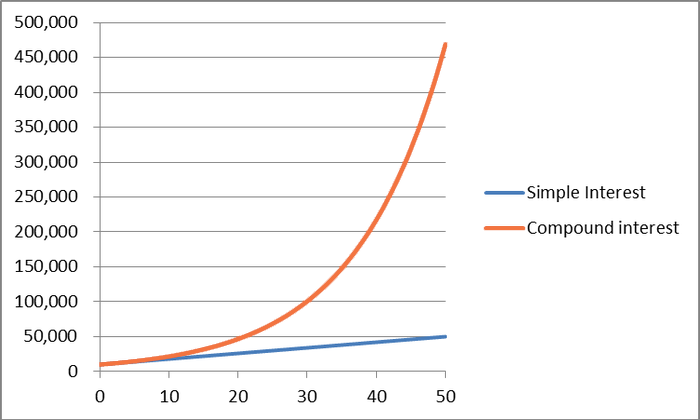

Quick review – compounding in finance is essentially interest paid on interest, and the cumulative effect is enormous. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest.

For example, Tara invests $10,000 at 8% annual compounded interest which means she is reinvesting gains. However, Dave invests the same amount of money at 8% simple interest. Dave pockets the $800 gain each year. After 30 years, the $10,000 investment for Tara would balloon to more than $100,000. In 50 years, her investment would reach more than $450,000. Meanwhile, Dave would only earn $50,000 after 50 years, which in comparison is a paltry sum.

The right answer for building a culture of data and analytics is not about choosing one capability, but rather the cumulative compounding effect from all of the capabilities.

How Does Compounding Interest Relate to Other Disciplines?

Not unique to finance, compounding can be applied to learning, relationships, biology, and many other disciplines. The key to leveraging the concept of compounding is valuing incremental progress and consistency. The practice starts seemingly slow, then accelerates in hockey-stick fashion.

While this phenomenon is no secret, the reality is that most people don’t take advantage of this principle to get richer, smarter, or more successful. That is because the benefits of compounding come towards the end of an investment, not the beginning. It’s hard for humans to optimize for the long term. In order to take a long-term approach, you have to get past simplistic opinions and the impulse for immediate gratification and focus on the consequences over time.

Companies that take this long game approach, show why some business leaders make the right decisions in building a data driven culture, whereas other reasonable decision makers do not.

How Are Some Companies Using a Short-Term Strategy to Their Analytic Investments?

The appeal of instant gratification is both real and instinctual. Many organizations jump from trend to trend, hunting for the silver bullet that will solve an immediate problem without considering the consequences. This would be considered a short-term, or the simple interest, approach to their analytic investment. More importantly, every time these companies start over, they lose out on the compounding effect. As a result, these businesses are using a rip and replace methodology to their own learned insights and are essentially multiplying their data and analytics competency equation by zero.

Consider the rise and fall of the data lake trend. There were interesting technological innovations that spurred the data lake movement, such as support for any data type and late binding. Also, open source software reduced the cost barrier to entry. These innovations solved real pain points around economically harnessing data with evolving structures.

However, eventually, many enterprises woke up to find they had dozens of silos with redundant data and sky-high compute and personnel costs. Further, the vast majority of enterprises who invested in these data lakes did so with little appreciation for governance, end-user tool compatibility, and operational implications, which restricted usability, adoption, and ultimately value. Essentially, the decision makers at companies who invested in data lakes were intelligent people, however, their investment was short-sighted. Had these business leaders considered the long-term consequences of certain design patterns, they may have chosen a different approach to realizing the benefits from the innovations.

How Can Companies Make Smart Decisions About Their Analytic Investment Strategy?

The companies, the ones leading the pack in data and analytics, find continued momentum and compounded return on their technological investments. These data and analytics leaders embrace innovation in a way that builds on the accumulated knowledge and the experience that preceded it. These business decision makers deliberate on how innovations can best be adopted to help address pain points and opportunities, within the context of their best results from previous investments. They build a foundation that allows them to benefit from what’s next.

There is core data such as customer, financial, service, and product data that most departments need. Therefore, analytic leaders need to take the necessary steps to promote reuse of core data, rather than allowing data drift and silos to occur. Reuse of data is compounding. The work associated with making data reliable, easy to navigate, and performant is expensive and time-consuming. However, when that data is used by multiple people, the average cost per use of that asset goes down.

For 17 consecutive years, Teradata has been recognized as a leader in Gartner’s Magic Quadrant for Data Management Solutions for Analytics. The market has radically evolved since 2002, when Teradata was first named a leader but Teradata remains at the forefront of data and analytics at scale.

Back then, enterprises were embracing workload management and scalable user concurrency. This knowledge was built upon, which lead to the developments in real-time loading. Over time, these capabilities were compounded with new forms of partitioning and indexes. Then came in database statistical processing, and later columnar structures. As new big-data types emerged like JavaScript Object Notation (JSON) and AVRO, those features got consumed into the platform. This knowledge was later compounded with machine learning algorithms and the benefits from running in the cloud. All of these advancements to Teradata’s offerings were the result of compounding knowledge. Teradata Vantage, our flagship hybrid cloud analytic software platform, is the culmination of the previous analytic developments and investments Teradata has made since its inception.

The result is a platform that can sustain the test of time because it’s forever growing and evolving. Currently, Vantage is one of the fastest growing products in Teradata’s history. It has also received the highest scores in all four use cases in Gartner’s Critical Capabilities report. Up next, we will build upon that previous knowledge to provide native object storage and deep learning capabilities.

The right answer for building a culture of data and analytics is not about choosing one capability, but rather the cumulative compounding effect from all of the capabilities. Only then can enterprises achieve the answers they are looking for: pervasive data intelligence.